The Coffee Klatch with Robert Reich

News:Politics

Friends,

That Donald Trump is now hawking digital trading cards featuring images of himself as a superhero for $99 each tells you all you need to know about Trump and about NFTs.

The recent implosion of Samuel Bankman-Fried’s FTX crypto market offers another case in point. Months ago, FTX was huge. Now it’s a hole in the pockets of countless people who had put their money into it. (Until a few week ago, Bankman-Fried was one of the world’s richest people.)

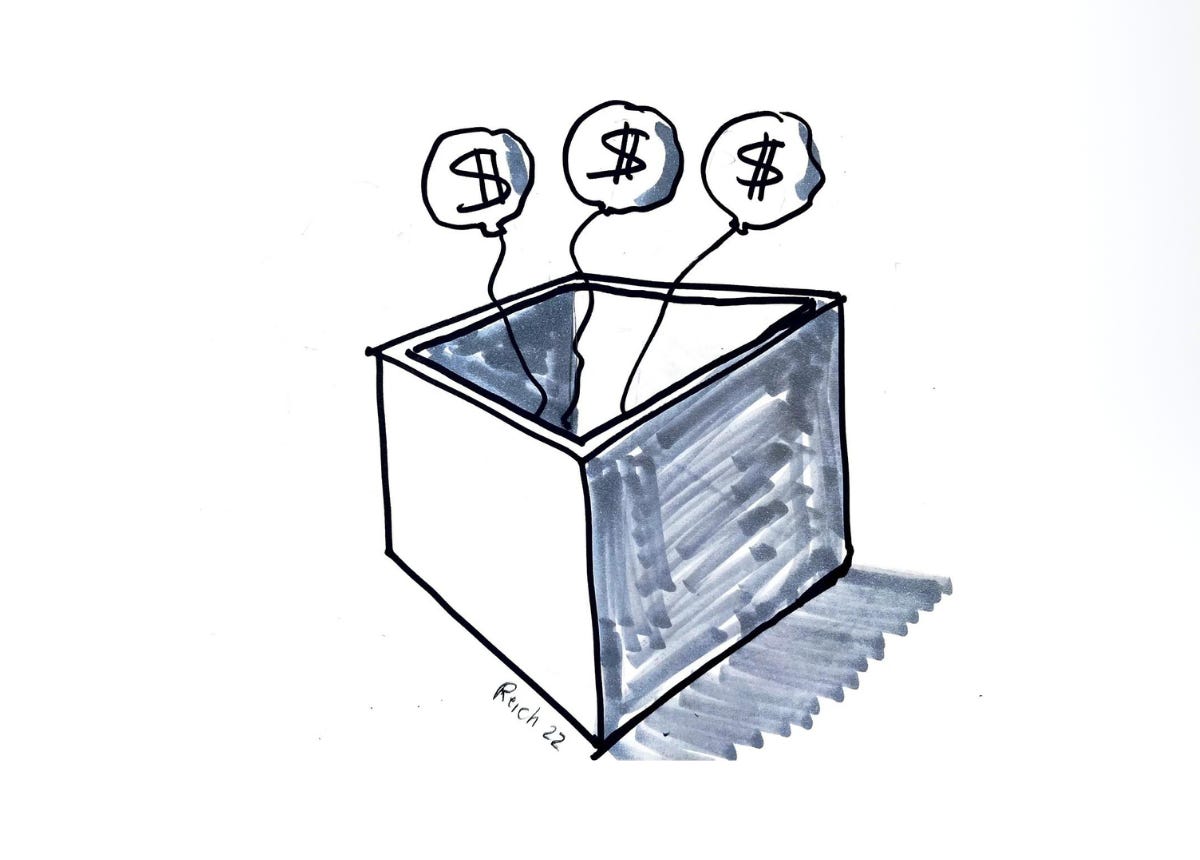

Crypto as a whole is proving to be little more than a giant zero-sum game. Like NFTs, crypto’s current value depends on whether buyers believe future buyers will be even bigger suckers.

A large and growing sector of the U.S. economy produces nothing of value. Nada. Zilch. Every winner comes at the expense of a current or future loser. The only things this “zero-sum” sector produces are many of the nation’s ultra-wealthy. Money moves from one set of pockets into another — mostly upward, into the pockets of the ultra-wealthy.

Much of Wall Street is expanding this zero-sum economy. Derivatives, private equity, hedge funds, and funds of funds, are creating a few fabulously wealthy people who could vanish tomorrow and be barely missed for all the net value they produce.

Corporate law is another part. High-paid lawyers representing one corporation battle high-paid lawyers representing another. Huge sums of money are spent on these escapades. But there are no societal gains unless you equate one corporation’s victory over another with justice.

Management consulting? Advising corporations how to make more money by cutting payrolls, abandoning communities, busting unions, outsourcing abroad, and pushing more jobs into contract work doesn’t add value. Some economists dub these “efficiencies” but if the social costs inflicted on everyone else are included, it’s zero-sum.

Public relations? How much value is created by convincing the public that a particular corporation or wealthy individual is nicer or worthier than we otherwise believe?

Then there’s the so-called “wealth management” industry — advising rich people where to park their money and how to avoid paying taxes. More zero-sum games.

In reality, the vast and growing zero-sum economy costs us dearly. It uses the time and energies of some of the nation’s best-educated people. They do it because zero-sum work pays so much compared to, say, teaching or social work or healthcare or journalism or art or science or many other things that improve peoples’ lives.

You might think a rational society would heavily tax zero-sum work while subsidizing work that generate lots of social good.

But you’d be wrong because the political power of the zero-sum economy generates an even bigger zero-sum game.

At this moment, for example, lobbyists for big corporations and private equity are pushing Congress for a retroactive tax break that would repeal limits on how much corporations can deduct in interest payments on their debts. (The limits went into effect this year as part of the compromise that gave us Trump’s big 2017 giveaway to the rich.) If the lobbyists get their way, the revenue loss could be about $20 billion per year, or around $200 billion over 10 years.

A big portion of that windfall will wind up in the pockets of private equity mavens who take over companies using piles of debt they then deduct from the companies’ income in order to minimize tax payments. These individuals already get special treatment in the tax code because they’re allowed to treat their incomes as capital gains subject to a lower tax.

I just got off the phone with a staffer for the House Ways and Means Committee who told me she thought it likely that this tax break will be attached to the omnibus funding bill now working its way through the last days of this Congress. She admitted there was “no justification” for it but sighed “that’s how the game is played.”

And who do you suppose pays more in taxes to make up for what these corpulent felines don’t pay? The rest of us.

Zero-sum.

This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit robertreich.substack.com/subscribe

More Episodes

Create your

podcast in

minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast

It is Free

- Privacy Policy

- Cookie Policy

- Terms of Use

- Consent Preferences

- Copyright © 2015-2024 Podbean.com