GoldFix (private feed for gemselle@yahoo.fr)

Technology

If BRICS agreed to centralize clearing, then they’ve already agreed on their universal settlement medium. That is Gold

Background

Friday in Gold Gets Closer to Centralized Clearing in BRICS Solution to SWIFT we we said this:

This is huge on many levels. We will gleefully break it down best we can in our Weekly post Sunday. It lies directly on the path of “things to do” when building an alternative to SWIFT.

As promised. This podcast unpacks *why* the BRICS agreeing on Centralized Clearing as a solution to counterparty risk necessitates Gold as the medium of exchange in *all* future international trade.

Podcast Flow

Intro:

* Clearing vs Exchanges

* What Clearing is

* Trading Culture and Clearing

Liars Poker and Limits of Bilateral Trade:

* Liars Poker and Bilateral trade and settlement (Mike, Mary and Jeff)

* Current (credit) accounts for Bilateral

* Spot and Bilateral limitations

* Lack of Trust issue

Centralized Clearing:

* Centralizing Risk: Bringing in the Boss

* Refrigerator as Settlement Medium in bilateral trade

* Uniform settlement medium established ( Boss’ dollars)

Dollar Distrust:

* What happens when you stop trusting the Boss

* Mike Mary & Jeff resume bilateral Trade

Alternative Solutions:

* Settlement medium gold

* Blockchain as verifier

Mercantilism, The Current Account, and Gold:

* Trade imbalances, current accounting

* Universally accepted Gold settles the difference

* 3 party example

Various Implications:

* Blockchain Makes Gold the MOE

* Centralized clearing risk

* Refrigerators, Different currencies and Gold

* Long Term Trade.

History of Money:

* SOV, MOE, and Unit of Accountancy

* Gold as money

* US Demonetization of Gold

* BRICS Remonetization of Gold

* Gold/Blockchain/central clearing as solution to rogue “Boss”

Settlement Mediums Beside Gold:

* Refrigerators, Armoirs, Chairs, and Gold

Podcast Ending:

Now you all know why I am so excited about the centralized clearing announcement. They cannot centralize clearing without a previously agreed upon settlement medium.That means they’ve decided on a new medium of exchange.

It means they already have a process in place to settle international trade in something other than dollars. And if it ain’t dollars, it is Gold

Podcast: Some Basic Definitions

CLEARING: To guarantee the risk on both sides of a transaction. In this way, to clear the trade-risk. The settlement on each transaction is also guaranteed by the clearing house.

SETTLEMENT: They make sure all participants agree on how/when/where transactions will be settled. They also police the settlement medium.

SETTLEMENT MEDIUM: aka medium of exchange ( MOE) A portable instrument used as an intermediary to facilitate/close/satisfy deals.

Summary: Centrally Cleared Gold as Solution to Dollar Mistrust

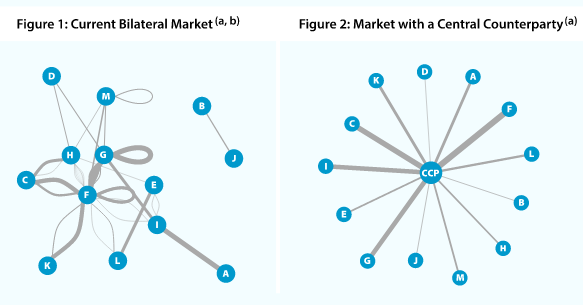

Centralized clearing helps scale trade efficiencies and overcome lack of bilateral counterparty trust. The trade-off is systemic risk in form of everyone trusting the central counterparty’s solvency and objectivity. One may to minimize/ police these risks is by the Central Counterparty being mutually owned by the trade members.

All members, however must agree on terms of trade. Key to this is what they will use as the official settlement medium if not dollars?

Current Bilateral BRICS Trade vs Centralized Clearing and Settlement…

By combining Gold, Blockchain, and centralized clearing a group of trade partners can expand trade without shrinking centralized trust.

Trade Before Centralized Clearing…

A word about Blockchain and Centralized Clearing

In November 2015, clearinghouses from several nations joined forces to create a think tank known as the Post Trade Distributed Ledger Group, which studies how blockchain technology can affect the way in which security trades are cleared, settled, and recorded. The Group, now includes around 80 financial institutions all around the world.

Their Conclusion: In short, Blockchain makes trade cheaper, faster, and more efficient without trusting any individual self-interested entity to maintain market neutrality.

Gold: If blockchain can maintain accounting objectivity, then gold’s monetary neutrality can be used as both SOV and MOE without needing to be shuttled around daily.

Liars Poker and Centrally Cleared Gold…

This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit vblgoldfix.substack.com/subscribe

More Episodes

2024-03-20

2024-03-20

2024-03-17

2024-03-17

2024-03-15

2024-03-15

2024-03-14

2024-03-14

2024-03-13

2024-03-13

2024-03-12

2024-03-12

2024-03-08

2024-03-08

2024-03-04

2024-03-04

2024-03-01

2024-03-01

2024-02-29

2024-02-29

Create your

podcast in

minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast

It is Free

- Privacy Policy

- Cookie Policy

- Terms of Use

- Consent Preferences

- Copyright © 2015-2024 Podbean.com