GoldFix (private feed for gemselle@yahoo.fr)

Technology

Housekeeping: Good Morning. Transcript tabbed. CTA related here

*** Silver CTAs, China Problems, Fiscal Put **

Contents

* Yesterday’s Activity

* Today’s Prices

* Today’s Data

* Markets/Metals Commentary

* Attached- CTAs

Markets Covered:

Metals, Energy, Crypto, Bonds, Stocks

Yesterday’s Activity:

Stock Meltup

* Metals took a big hit, mostly industrial, Silver. Oil did well

* US equities continued to rally on Monday as the S&P 500 closed at a new high and the Dow ended above 38,000 for the first time

* Industrials (+0.74%) and real estate (+0.44%) outperformed the broader market indices, while consumer discretionary (-0.52%) and utilities (-0.52%) underperformed

h/t DataTrek

Overnight Activity:

* Oil soft, gold strong, dollar weak in Asia now somewhat reversed

* BOJ unchanged on easy policy.

* China bazooka talk again

Week’s Data:

Earnings, LEI, PMI, PCE, and GDP

* MONDAY, JAN. 22 10:00 am LEI

* TUESDAY, JAN. 23 None scheduled

* WEDNESDAY, JAN. 24 9:45 am PMI

* THURSDAY, JAN. 25 8:30 am Q4 GDP

* FRIDAY, JAN. 26 8:30 PCE

Total Calendar

News:

NOTABLE HEADLINES

China is said to consider an equity market rescue package backed by USD 278bln- or about 1 Elon Musk

PBoC leaders will hold a press conference on Wednesday at 07:00GMT/02:00EST to introduce the implementation of financial support for the real economy

GEOPOLITICS

Israel proposed a two-month fighting pause in Gaza for the release of all hostages

some headlines via NewSquawk

Markets/Metals Commentary:

* Gold- stronger in Asia, backing off now

* Silver:

* Crypto: weak and getting weaker

* Oil: give back some of yesterday gains so far

* stocks are good with this behavior so far. recession/ stimulus half full

* The Fed put concept is being thrown about again. It’s fiscal this time and closely related to the policy of using fiscal side to grow economy and monetary side to put brakes on it- Antigoldilocks, economic engine reset, deglobalization, mercantilism, supply chains, inflationary headwinds, retooling, anti financial leverage and pro-operational leverage again

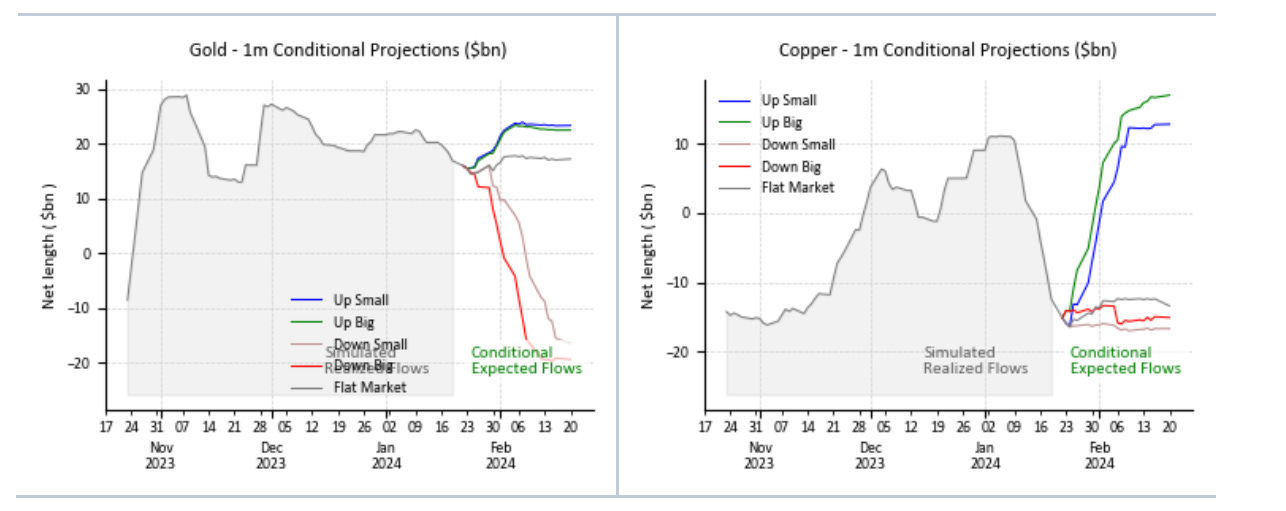

Silver CTAs are very short and very profitable right now just like they are Oil. But in oil they are starting to Cover. They will cover in Silver as well. But you need a catalyst like:

* China stimulus- They will say it

* Physical demand like India- The EFP will show it

* Fed Easing- We will hear it

This is very early in the game but it is now on our radar once again is the catalyst we need for a rally

* Read more here

End

CTA Analysis

More Episodes

2024-02-08

2024-02-08

2024-02-07

2024-02-07

2024-02-02

2024-02-02

2024-02-01

2024-02-01

2024-01-31

2024-01-31

2024-01-29

2024-01-29

2024-01-29

2024-01-29

2024-01-26

2024-01-26

2024-01-18

2024-01-18

2024-01-17

2024-01-17

Create your

podcast in

minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast

It is Free

- Privacy Policy

- Cookie Policy

- Terms of Use

- Consent Preferences

- Copyright © 2015-2024 Podbean.com