The Glenn Show (private feed for Tezike@gmail.com)

Society & Culture

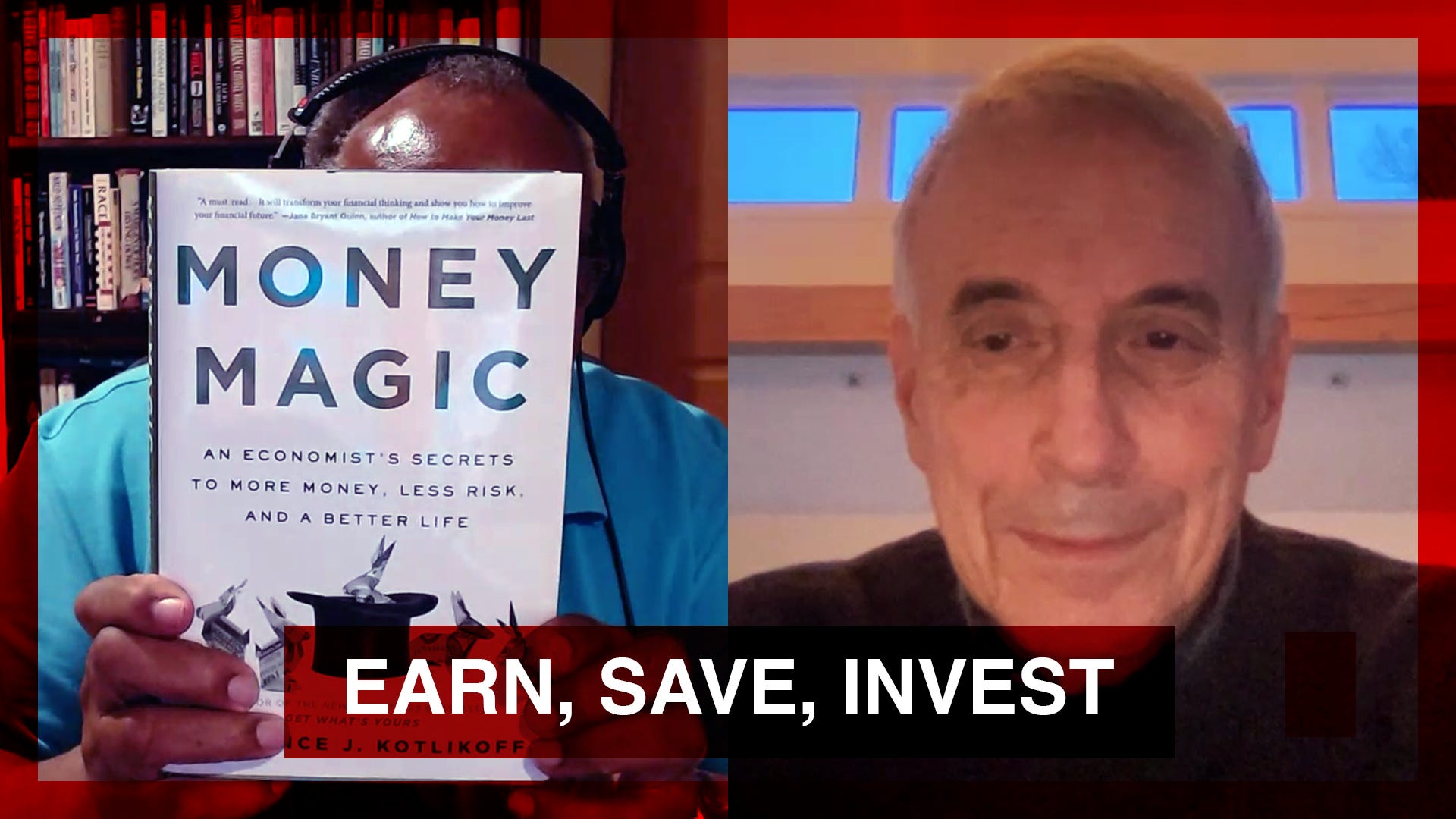

Here at The Glenn Show, I’m taking a little break from politics and culture to talk dollars and cents. My good friend and former Boston University colleague Larry Kotlikoff is here to discuss his new book, Money Magic: An Economist’s Secrets to More Money, Less Risk, and a Better Life. In it, Larry brings his knowledge and expertise as an economist to bear on the everyday problems of spending, saving, and investing. In this episode, he shares some of that advice with TGS viewers.

But, wait a minute. Larry is a serious academic economist. Why did he write an advice book? He explains what he’s trying to accomplish with Money Magic. Larry talks about why investing in stocks may not be the best use of your money even when the market is up (especially if you’re carrying debt). I ask Larry about some of my own recent experiences managing my money, and he breaks things down in a way that non-economists can understand. For example, he says, if someone (including the U.S. government) is trying to sell you on a financial product that seems really, really complicated, it’s probably a swindle. What about major life decisions, like divorce? Even then, Larry says, you’re better off balancing the costs and benefits than making a decision without considering the financial consequences. We then get into education. Millions of people in this country carry unmanageable loads of student debt. But Larry thinks you can get an elite education without going into debt at all, and he explains how. Why does the federal government issue student loans, anyway? And is there a more equitable way it could arrange for repayment? Finally, Larry and I get into our personal history and talk about what makes successful individuals the way they are.

Whether you’ve got pressing financial questions or not, you’ll want to hear what Larry has to say.

This post is free and available to the public. To receive early access to TGS episodes, an ad-free podcast feed, Q&As, and other exclusive content and benefits, click below.

0:00 Larry’s new book, Money Magic: An Economist’s Secrets to More Money, Less Risk, and a Better Life

4:36 Why did Larry, a serious academic economist, write a financial advice book?

14:23 Why investing in stocks may not be as safe as it seems in the long term

24:17 Larry: If a personal finance product is complicated, it’s a swindle

29:34 An economist’s guide to divorce

32:48 Is a free online Stanford education more valuable than a debt-laden traditional degree?

44:20 Why does the government offer student loans?

51:12 Larry: “We’re all self-made people at some level”

Links and Readings

Larry’s new book, Money Magic: An Economist’s Secrets to More Money, Less Risk, and a Better Life

Glenn’s classic 1981 paper, “Intergenerational Transfers and the Distribution of Earnings”

Thank you for subscribing. Leave a comment or share this episode.

More Episodes

2022-07-04

2022-07-04

2022-06-28

2022-06-28

2022-06-13

2022-06-13

2022-05-16

2022-05-16

2022-05-14

2022-05-14

2022-04-25

2022-04-25

2022-04-05

2022-04-05

2022-04-04

2022-04-04

Create your

podcast in

minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast

It is Free

- Privacy Policy

- Cookie Policy

- Terms of Use

- Consent Preferences

- Copyright © 2015-2024 Podbean.com