The Earl of the Eurodollar Jeff Snider (@JeffSnider_AIP), Chief Investment Officer at Alhambra Investments and Emil Kalinowski (@EmilKalinowski) discuss the four topics.

First, what happened this past week when the price of oil to be delivered in May was priced at a negative $50(ish) dollars per barrel? And much more importantly than the bizarre price, what does the back-half of the oil futures curve say about the medium-term condition of the global economy? Nothing good unfortunately.

Second, why do well respected names in the financial industry continue to believe that US Treasury yields will rise? They are called Bond Kings and one of them recently had to take off his crown (temporarily). But was it the Fed's changing policy that caused the change of heart? Or was it the bond market all along who was signaling the bond kings wore crowns but nothing else?

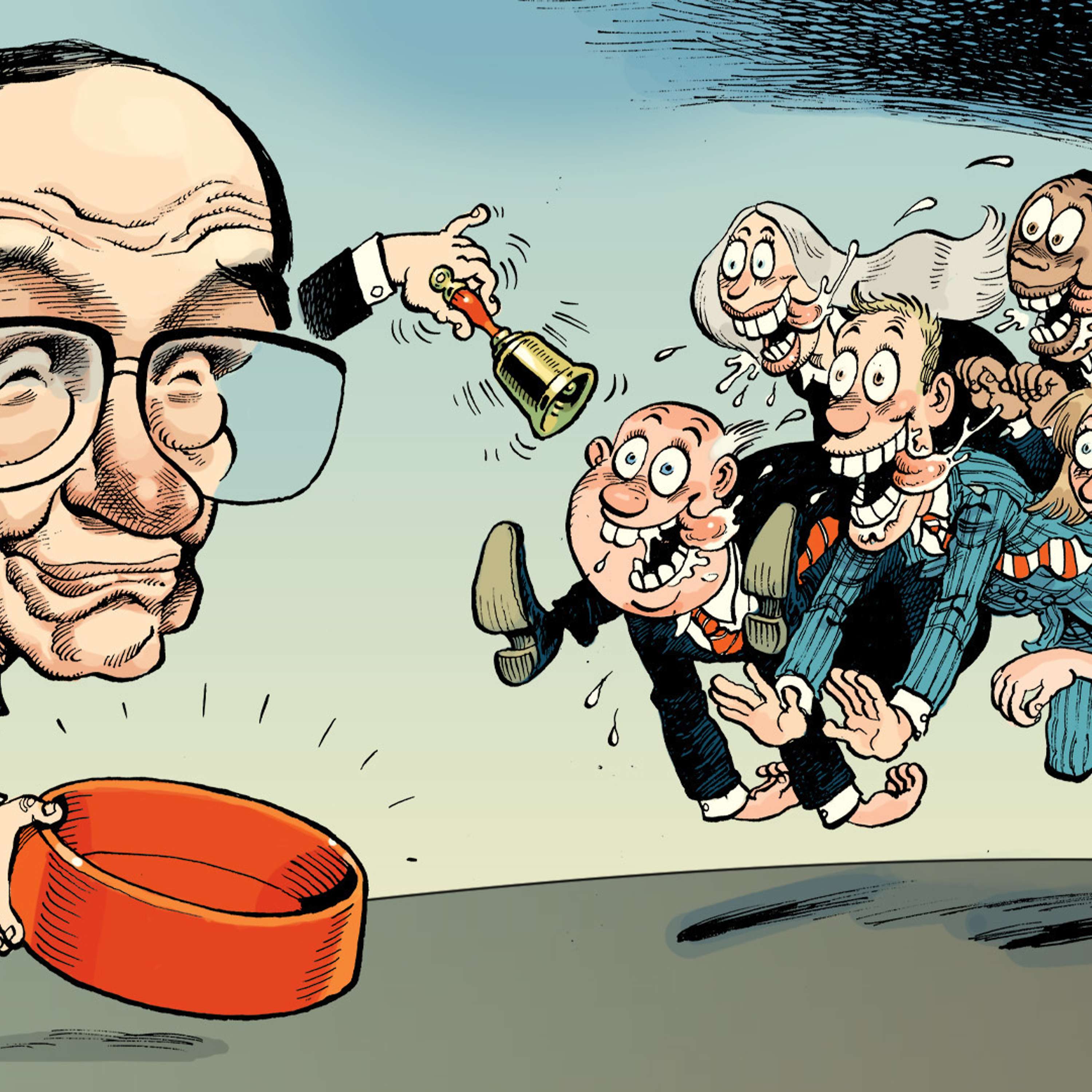

Third, the important German ZEW survey shows very sharp pick-up in optimism. No surprise, ZEW survey respondents traditionally respond very positively to central bank 'liquidity' programs, even if the real economy does not follow through. It is the legendary Greenspan Put gone international.

Fourth, the multi-decade Japanese experience regarding 'overwhelming' purchases of stocks and bonds is instructive for investors counting other advanced economy central banks buying financial instruments. It seems bullish, on the surface at least. But recently the Bank of Japan opened the taps and increased their equity purchases to record amounts. The result? A 31 percent decline. You're welcome.

Alhambra Investment articles discussed:

Let Japan Show You Again Just How Laughable The Idea That Central Banks Can Support Markets

The Greenspan Bell

The Fallen Kings & The Bond Throne of Collateral

What Was Monday’s Negative Oil, And Why It Was Overshadowed On Tuesday

More Episodes

2024-01-26

2024-01-26

2024-01-22

2024-01-22

2024-01-19

2024-01-19

2024-01-18

2024-01-18

2024-01-17

2024-01-17

2024-01-15

2024-01-15

2024-01-10

2024-01-10

2024-01-09

2024-01-09

2024-01-08

2024-01-08

Create your

podcast in

minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast

It is Free

- Privacy Policy

- Cookie Policy

- Terms of Use

- Consent Preferences

- Copyright © 2015-2024 Podbean.com