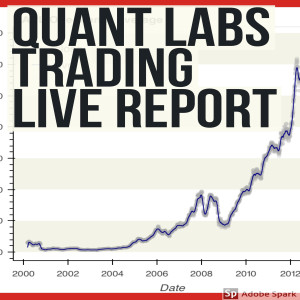

Welcome to a new episode with Brian from Monolabs. This episode is focused on the analysis of trading algorithms, specifically how to evaluate and enhance the quality of their trading signals. This information-packed session is an invaluable resource for everyone keen on optimizing their trading strategies.

Get some free trading tech book PDFs http://quantlabs.net/books

Join our Discord for quant trading and programming news https://discord.gg/k29hRUXdk2

Don’t forget to subscribe to my Substack for more trading tips and strategies! Let’s keep learning and growing together. https://quantlabs.substack.com/

Brian dives into a question posted on quant.stackexchange.com about how to deeply assess a trading signal. Discussing it from the perspective of a company's performance under different market conditions on various instruments. The takeaway is the development of a multi-layered approach to evaluation- measuring performance based on instruments, sectors, market volatility, and more.

The episode subsequently explores how to select well-performing sectors, employing strategies such as using forward guidance and assessing professional analyst recommendations. It unravels how to filter through stocks and ETFs to find those that best meet specific conditions. The focus is on identifying companies demonstrating strong forward guidance and low volatility.

Timing is highlighted as a key element throughout the analysis. Brian also highlights the importance of avoiding high volatile stocks and ETFs under volatile market conditions. Also noteworthy is the importance of high performing sectors tracking and using ETF holdings to measure stock performance.

Brian also provides enlightening insights on how to manage top-performing, low volatile, and well-timed stocks that could break out. Also highlighted is how to manage exposure to market losses caused by underlying challenging market conditions.

Moreover, the episode provides valuable strategies on stock analysis such as identifying strong guidance and recommendations. It also outlines how to design custom strategies for platforms like TradingView using Ichimoku.

This and much more information about trading algorithms and signal quality can be accessed in our community on Discord, available training books on Excel and Java, and through our sub-stack. All links are available in the description.

Don't miss out on these invaluable insights. Join us and let’s level up our trading game! We look forward to having you on board!

Methods to Improve Signal Quality for High Performance - QUANTLABS.NET

More Episodes

2024-03-06

2024-03-06

116

116

2024-03-05

2024-03-05

124

124

2024-02-27

2024-02-27

148

148

2024-02-26

2024-02-26

128

128

2024-02-24

2024-02-24

111

111

2024-02-23

2024-02-23

106

106

2024-02-22

2024-02-22

119

119

2024-02-12

2024-02-12

168

168

2024-02-07

2024-02-07

170

170

2024-02-07

2024-02-07

120

120

2023-11-24

2023-11-24

382

382

2023-11-13

2023-11-13

245

245

2023-11-10

2023-11-10

144

144

Create your

podcast in

minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast

It is Free

- Privacy Policy

- Cookie Policy

- Terms of Use

- Consent Preferences

- Copyright © 2015-2024 Podbean.com